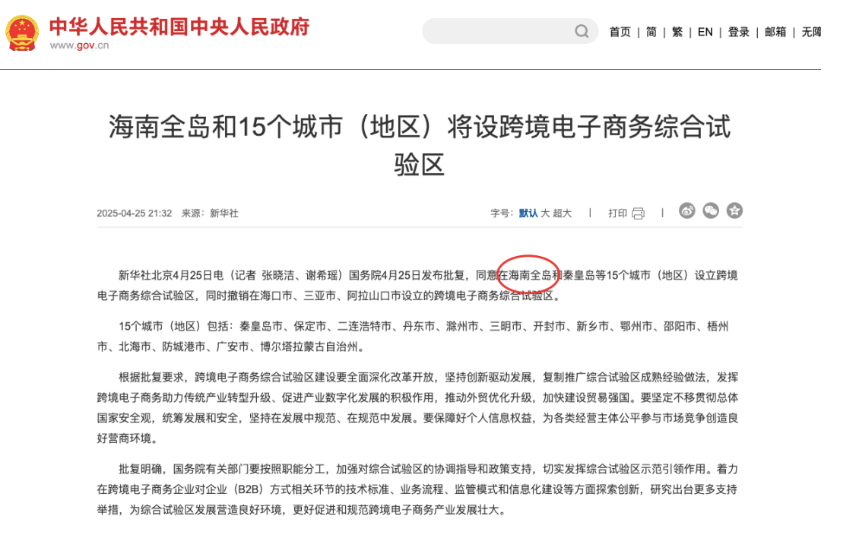

Beijing, April 25, Xinhua News Agency The State Council issued a reply on April 25, agreeing to set up cross-border e-commerce comprehensive pilot zones in 15 cities (regions) including Hainan Island.

What is cross-border e-commerce Comprehensive Pilot Zone?

Generally speaking, it is a super service area specially created by the government for the cross-border e-commerce industry in Hainan Island. In this service area, various policies and benefits are full, taxes are given to you, customs clearance procedures are simplified for you, and logistics payment and other supporting facilities will also follow the approval and accelerate the construction.

In this way, the cost of cross-border e-commerce enterprises will be reduced, the efficiency will be improved, and the development prospect is broad!

Hainan itself is a free trade port, with the unique advantages of zero tariff, low tax rate and simple tax system. Coupled with the policy support of cross-border e-commerce comprehensive pilot zone, it can be said that the future will usher in broad prospects after the closure.

In the future, cross-border data flow and fund settlement will be more convenient, which will surely attract a large number of domestic cross-border e-commerce enterprises, logistics enterprises and financial institutions to settle in Hainan, forming a new model of front store and back warehouse in Hainan, driving the rapid development of the industry.

This time, The State Council approved the establishment of cross-border e-commerce comprehensive pilot zone, which can be said to be a new opportunity for us!

Speaking of this, do you also want to seize the opportunity to fight in the cross-border e-commerce industry? Today, Xiao Bian will sort out the unique advantages and preferential policies of cross-border e-commerce in Hainan, as well as the detailed process of registering cross-border e-commerce companies in Hainan. Let’s take a look! Comprehensive pilot zone for cross-border e-commerce.

Part1.Advantages of Hainan to do cross-border e-commerce

01. Policy support of Hainan Free Trade Port

Double 15% tax preference: Corporate income tax and individual income tax are reduced by 15%, which is the unique preferential tax policy of Hainan Free Trade Port. For cross-border e-commerce companies, this means higher profit retention, which helps them increase research and development investment, expand market and improve service quality.

Zero tariff policy: Hainan Free Trade Port implements the list management system, and goods outside the list are exempted from tariffs. It reduces the import costs of cross-border e-commerce enterprises, enables more high-quality goods to enter the Chinese market at more preferential prices, and also encourages domestic goods to go to the world, enhancing the competitiveness of international trade.

Export TAX REBATES: REFUNDS OF VALUE-ADDED TAX and CONSUMPTION TAX TO EXPORT goods directly reduce the tax burden of export enterprises, improve the price advantage of export products, and promote the growth of export trade.

Simplified tax system: Through the implementation of the “five-in-one” simplified tax system, which combines multiple taxes and simplifies the tax process, the tax compliance costs of enterprises are reduced and the operational efficiency is improved. A more transparent and efficient tax environment has been created for cross-border e-commerce enterprises.

Tax return policy: Enterprises entering Hainan Free Trade Port can enjoy high tax return policy, the tax return ratio is between 30% and 80%. It not only attracts a large number of enterprises to settle in, but also further reduces the operating costs of enterprises and enhances their market competitiveness.

Convenient customs clearance: Hainan implements the supervision model of “opening the first line and controlling the second line”, which facilitates the entry and exit of goods, especially suitable for the rapid logistics needs of cross-border e-commerce.

Offshore trade support: Encourage offshore trade and allow enterprises to conduct international settlement and capital flow through the Hainan platform.

02. Hainan’s superior geographical location

Hainan is located in southern China and adjacent to the Southeast Asian market. It is an important hub connecting China and ASEAN countries.

Reach Southeast Asian market: Hainan’s geographical location makes it an ideal springboard to enter the Southeast Asian market, especially for cross-border e-commerce enterprises catering to ASEAN countries, with lower logistics costs and shorter transportation times.

International airline network: Hainan has several international airports and ports, which facilitate the rapid import and export of goods and shorten the distribution cycle.

Advantages of climate conditions: Hainan is warm and humid throughout the year, suitable for storage and transportation of certain temperature sensitive goods (such as fresh food).

03. Hainan is a comprehensive pilot zone for cross-border e-commerce

Hainan is listed as a national cross-border e-commerce comprehensive pilot zone, enjoying the following facilities:

Perfect infrastructure: Hainan is accelerating the construction of cross-border e-commerce industrial parks, bonded warehouses and logistics centers to provide hardware support for enterprise development.

One-stop service: Provide enterprises with registration, customs clearance, payment, logistics and other full-process services to reduce the difficulty of operation.

Policy pilot opportunities: As a pilot zone, Hainan can take the lead in trying new cross-border e-commerce policies and models to help enterprises seize market opportunities.

04. International cooperation and exhibition resources

Hainan regularly holds international exhibitions such as Boao Forum for Asia and Consumer Goods Expo, providing a platform for cross-border e-commerce enterprises to display and cooperate:

Brand exposure opportunities: By participating in the exhibition, enterprises can reach more international buyers and partners.

Facilitation of investment: Hainan government actively attracts foreign investment and provides financing channels and cooperation opportunities for cross-border e-commerce enterprises.

05.Freedom to transfer funds across borders

Cross-border e-commerce enterprises can open Hainan Free Trade Account (EF account) to realize direct conversion with currencies of different countries and facilitate foreign exchange management. It not only reduces the exchange rate risk and transaction cost of enterprises, but also promotes the free flow of funds, which provides strong support for the global operation of cross-border e-commerce enterprises.

06.Tax free development on outlying islands

Hainan provides an annual duty-free shopping quota of 100,000 yuan per person for tourists from outlying islands, which greatly stimulates the prosperity of the duty-free market in outlying islands. In 2023, the duty-free shopping volume of Hainan’s outlying islands exceeded 43.7 billion yuan, fully demonstrating the great potential of this policy. For cross-border e-commerce, the tax exemption policy on outlying islands not only attracts a large number of international tourists, but also provides rich commodity resources and a large consumer group for cross-border e-commerce platforms, which promotes the rapid growth of cross-border e-commerce business.